This week the Global Steering Group for Impact Investing hosted its annual Impact Summit in Buenos Aires, following a last-minute venue change from Santiago after weeks of civil unrest in Chile. This is the third international gathering (along with the APEC Summit and COP25) to be cancelled amid growing tensions related to decades of income inequality in the country. With all eyes on Chile, the protesters brought attention to critical issues affecting millions across the globe: poverty, job insecurity, and poor access to quality education and health care.

With just 11 years remaining to achieve the ambitious Sustainable Development Goals (SDGs), the international community is focused on generating not just more, but also better, financing for development. A key part of this will be to ensure that funding reaches disadvantaged populations through the most effective service providers—those providing the right mix of services to fit the needs of their beneficiaries.

Impact bonds—a type of outcome-based financing where private (impact) investors provide upfront capital—allow service providers the flexibility to manage adaptively while driving improvements in their delivery. Globally, 173 impact bonds have been contracted, with most of these deals in high-income countries. In developing countries, there are currently only 17 impact bonds contracted (see Figure 1 below).

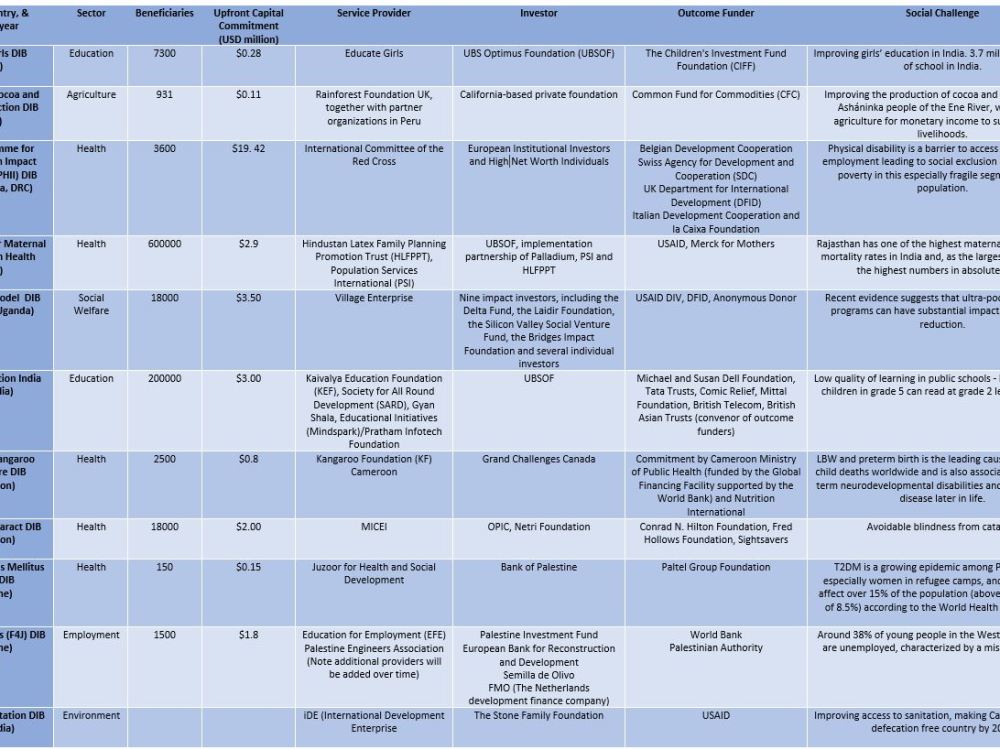

Figure 1: Map of contracted impact bonds in developing countries Of these contracted deals, 11 are development impact bonds (DIBs), where the outcome payer is a third party, such as a donor. The remaining six have domestic government outcome payers, and are therefore social impact bonds (SIBs), although many also have third party outcome payers. The key sectors have thus far been health and employment (Figure 2), although interest in education has been rising, with efforts to launch outcome funds in India and Africa and the Middle East. Some of the initiatives within these sectors include interventions for maternal and child health in India and Cameroon, early childhood development in South Africa, and employment in Colombia, Argentina, and Palestine. To date, nearly 900,000 individuals have been targeted in impact bonds in developing countries, with a range from 150 to 600,000 people, though the median size of impact bonds in developing countries is 2,500.

Of these contracted deals, 11 are development impact bonds (DIBs), where the outcome payer is a third party, such as a donor. The remaining six have domestic government outcome payers, and are therefore social impact bonds (SIBs), although many also have third party outcome payers. The key sectors have thus far been health and employment (Figure 2), although interest in education has been rising, with efforts to launch outcome funds in India and Africa and the Middle East. Some of the initiatives within these sectors include interventions for maternal and child health in India and Cameroon, early childhood development in South Africa, and employment in Colombia, Argentina, and Palestine. To date, nearly 900,000 individuals have been targeted in impact bonds in developing countries, with a range from 150 to 600,000 people, though the median size of impact bonds in developing countries is 2,500.

Figure 2: Impact bonds by sector in developing countries While the first impact bond in a high-income country was contracted in 2010, the financing tool has only been active in developing countries since 2015, which marked the launch of the Educate Girls DIB in India, and a DIB for sustainable cocoa and coffee in Peru. Despite considerable interest from a wide range of development actors in testing and learning about the model, market growth has been relatively slow. For our 2017 report, we developed comprehensive factsheets on 28 impact bonds (both in design and contracted) in developing countries. At that point, only four of these impact bonds had been contracted. Since then, an additional nine impact bonds from our factsheets have entered implementation, as well as four projects that we have learned about since the report. More than half of the deals featured in our 2017 report have not yet signed contracts with all parties.

While the first impact bond in a high-income country was contracted in 2010, the financing tool has only been active in developing countries since 2015, which marked the launch of the Educate Girls DIB in India, and a DIB for sustainable cocoa and coffee in Peru. Despite considerable interest from a wide range of development actors in testing and learning about the model, market growth has been relatively slow. For our 2017 report, we developed comprehensive factsheets on 28 impact bonds (both in design and contracted) in developing countries. At that point, only four of these impact bonds had been contracted. Since then, an additional nine impact bonds from our factsheets have entered implementation, as well as four projects that we have learned about since the report. More than half of the deals featured in our 2017 report have not yet signed contracts with all parties.

Who is engaged in impact bonds in developing countries?

A range of actors have played different roles across the contracted deals, including as outcome funders, investors, service providers, and intermediaries, as well as other organizations offering grant funding and technical assistance.

A variety of outcome funder organizations are engaged across the seventeen DIBs and SIBs. As Figure 3 outlines below, there are seven projects that involve a foundation/philanthropist providing outcome funding, in addition nine that involve a multilateral/bilateral, and seven that involve domestic government outcome funding. Most of the SIBs in developing countries can be more accurately characterized as hybrids, with outcome funding from both domestic government and third-party sources. For example, the SIB for early childhood education in South Africa combines funding from the Department of Social Development and the ApexHi Charitable Trust.

Figure 3: Who is paying for outcomes?

A wide range of investor types have engaged in impact bonds in developing countries. However, we find that foundations/philanthropists are the most common type of organization providing upfront capital in these deals, with at least one involved in 12 of the 17 deals. This includes, for example, the UBS Optimus Foundation, which has invested in all three DIBs in India, as well as Fundación Corona, Fundación Bolivar Davivienda, Fundación Mario Santo Domingo, each of which invested in both the Colombia Workforce SIB and the Cali Employability SIB. Other organization types which serve as investors include nonprofits, investment funds, and commercial banks. NGOs/nonprofits are by far the most common service providers, engaged across 14 of the 17 impact bonds where data is available. Three of the impact bonds include services provided by for-profit organizations and two are provided by foundations.

Several bilateral and multilateral organizations have engaged in impact bonds: For example, the Swiss Secretariat of Economic Affairs has provided outcome funding for both SIBs in Colombia, while the Inter-American Development Bank has acted as an outcome payer in the same deals. The UK’s Department for International Development (DFID) is an outcome funder in the Village Enterprise DIB in Kenya and Uganda, and the International Committee of the Red Cross DIB.

Conclusion

In addition to the 17 projects analyzed here, we continue to track a number of impact bond projects in the works. We are constantly updating our database, to make sure our global snapshot provides the most accurate real-time data. We are also tracking the evolution of the market and observing increased adaptation in the types of model being used—for example, in the piloting and adaptation of the South Africa inclusive youth employment SIB. At Brookings, our research will continue to analyze the global market, with a focus on the critical factors for efficient and effective outcome-based financing. Most importantly, we care about the role that impact bonds may play in shifting mindsets of both domestic and development funders so that the needs of all citizens are met.

Contracted Social Impact Bonds (SIBs) in developing countries  Source: Brookings Institution Global Impact Bonds Database

Source: Brookings Institution Global Impact Bonds Database

*Note: Unless provided in USD, local currency converted to USD using date of contract signing

Click on the table to view the full image.

Contracted Development Impact Bonds (DIBs) in developing countries  Source: Brookings Institution Global Impact Bonds Database

Source: Brookings Institution Global Impact Bonds Database

Note: Unless provided in USD, local currency converted to USD using date of contract signing

Click on the table to view the full image.

Commentary

From Colombia to Cameroon: The gradual growth of impact bonds in developing countries

Emily Gustafsson-Wright,

Emily Gustafsson-Wright

Senior Fellow

- Global Economy and Development, Center for Universal Education

@EGWBrookings

Izzy Boggild-Jones, and

Izzy Boggild-Jones

Former Senior Research Analyst

- Center for Universal Education

Onyeka Nwabunnia

ON

Onyeka Nwabunnia

Former Project Coordinator

- Center for Universal Education

November 21, 2019